21Shares co-founder doubts bitcoin will reprise its January rally

21Shares’ Ophelia Snyder doubts bitcoin will reprise its January rally.

Bitcoin is unlikely to reprise the surge it posted in January 2025, 21Shares co-founder Ophelia Snyder said, reported Cointelegraph.

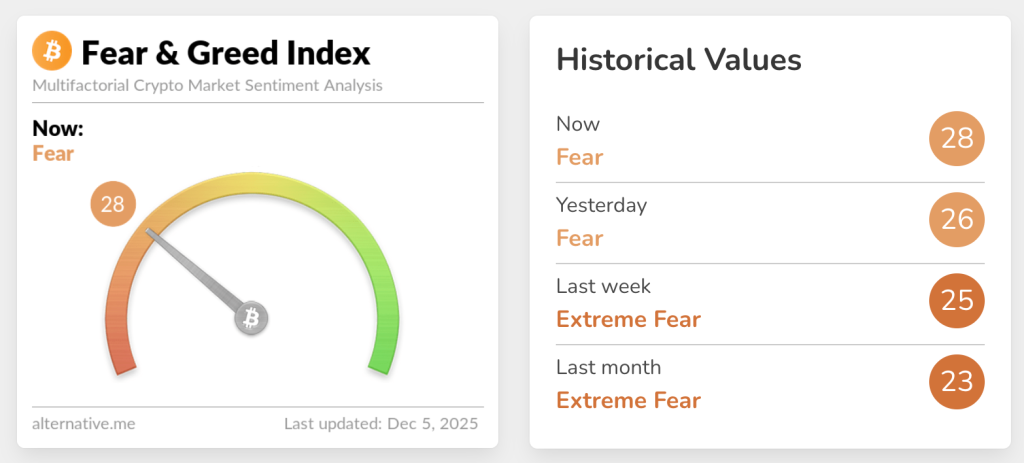

She cited a lack of investor optimism as the main obstacle. The popular market sentiment indicator has been stuck in the “fear” zone since October.

“It is unlikely that the drivers of current volatility will be fully resolved in the short term. A repeat of January’s success would largely be a function of overall market sentiment,” the expert said.

Analyst Axel Adler Jr noted that trader activity is “near the lows of the current cycle”.

Average weekly spot and futures trading volumes declined by another 204K BTC, down to 320K BTC. Activity is near cycle lows, and the market feels sluggish again. pic.twitter.com/7ZU89t9nJ1

— Axel 💎🙌 Adler Jr (@AxelAdlerJr) December 5, 2025

Average weekly spot and futures volumes fell by 204,000 BTC to 320,000 BTC.

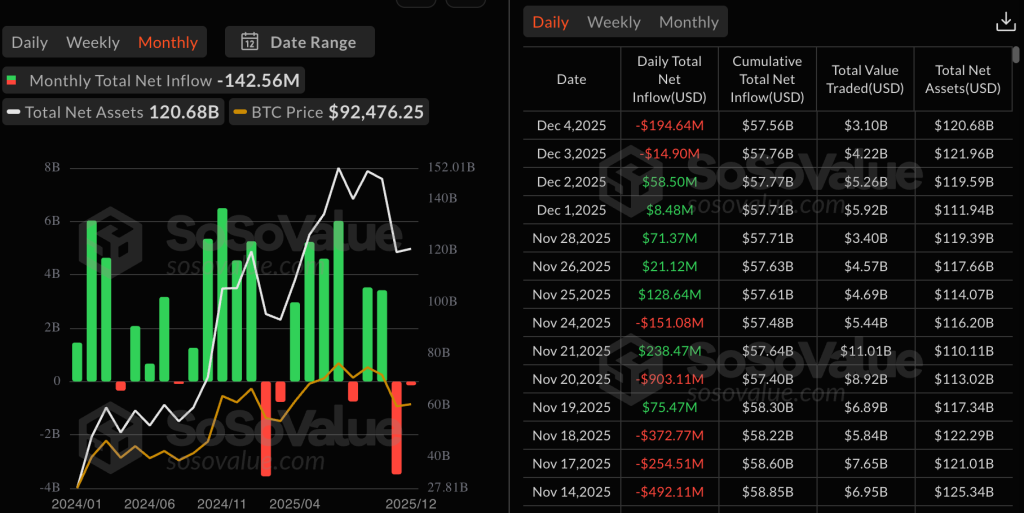

Institutional interest is weak as well. In November, $3.4bn was pulled from exchange-traded funds—the second-worst month since launch. Early December continued the negative trend, with $142m in net outflows.

However, Snyder noted that this cohort often becomes active in January—at the start of the year they rebalance and review portfolios.

In January 2025 bitcoin hit an all-time high of $109,000 ahead of the inauguration of U.S. president Donald Trump. The rally was aided by the politician’s stance, who pledged to turn the United States into the “crypto capital of the world” and to replace regulatory pressure with support for the industry.

Over the year the “digital gold” repeatedly set new records. The latest peak came in October, when the price rose above $126,000. A protracted downtrend followed: in November quotes fell to $80,000.

Many market participants revised their short-term forecasts. For example, Galaxy Digital analysts lowered their year-end 2025 target for the first cryptocurrency to $120,000, from a previous $185,000.

A rally is still possible

The 21Shares co-founder stressed she remains optimistic over the long term:

“I feel confident because I view this latest correction as a response to overall risk-off behavior due to broader market conditions, rather than anything specific to cryptocurrencies.”

She cited as key catalysts the launch of new crypto ETFs, government adoption of digital assets and growing demand for stores of value beyond gold.

At the time of writing the market’s flagship trades around $91,400, down 1.7% over the past 24 hours.

Analyst Darkfost noted that the asset needs to reclaim $96,956. This level corresponds to the realized price for the “youngest” group of long-term holders.

The first area we want Bitcoin to reclaim is the Realized Price of the youngest LTH band.

🔁 This level marks the transition between STH and LTH and currently sits at $96 956.

This zone matters because breaking above it would put those investors back into a comfortable… pic.twitter.com/T3GVPWJm3d

— Darkfost (@Darkfost_Coc) December 4, 2025

“This zone matters because breaking above it would put those investors back into a comfortable position, restore their expectations of potential profit and encourage them to keep holding rather than selling, which would introduce some stability,” he explained.

Until bitcoin manages to close above $97,000, “caution is warranted”, the expert said.

Trader Michaël van de Poppe allowed for a pullback to $85,000 if $92,000 is lost. Despite that, he believes the correction is over. In his view, bitcoin is forming a base for fresh all-time highs.

#Bitcoin keeps hanging on the same price levels.

Direction is still unclear; if we lose this level, we might retest anywhere in the $85K ballpark for a final sweep and some sort of double bottom pattern.

I still think that we’re done with this entire correction and are forming… pic.twitter.com/2u2NPTv51r

— Michaël van de Poppe (@CryptoMichNL) December 5, 2025

“If the $91,500 level acts as support, then I assume we will see a test of $100,000 next week,” he concluded.

Earlier, CryptoQuant CEO Ki En warned of the risks of a prolonged bitcoin decline. According to him, most on-chain indicators point to a bearish scenario.

However, traders estimated the probability of a “crypto winter” at 7%.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!